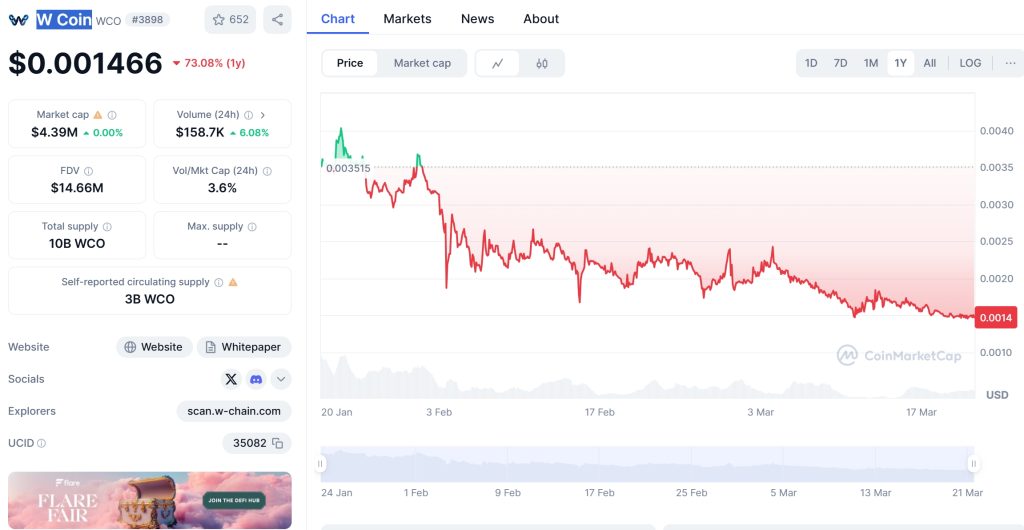

There’s arguably no hotter topic in the crypto world right now than W Coin (WCO). It’s been a rollercoaster journey for WCO, seeing a recent price drop from $0.001446 to $0.001465, sparking intense discussions among investors. In 2025, WCO has already faced a 10.6% decline over the past week, yet it remains a coin of interest with its unique features and potential for recovery. Let’s dive into this fascinating world of WCO and see what the future holds.

Contents

Can W Coin Recover After Dropping to $0.001465?

W Coin’s recent price drop has left many investors pondering its future trajectory. The key question on everyone’s mind: Can WCO bounce back from its current price of $0.001465? To understand this, let’s look at the broader crypto market and compare WCO’s situation to that of other cryptocurrencies.

Take Dogecoin, for instance. Dogecoin saw a significant price drop in the past, triggered by market sentiment shifts and Elon Musk’s tweets. Despite the initial plunge, Dogecoin managed a recovery, driven by increased adoption and community support. WCO, on the other hand, faces different market conditions, with its decline attributed to broader market trends and less direct influence from high-profile endorsements.

However, WCO has a few aces up its sleeve. Its unique features, such as the clawback mechanism and the token recycle ecosystem, offer a level of security and flexibility that could attract more users and stabilize its price. If WCO can leverage these strengths and navigate the current market volatility, a recovery is certainly within reach.

What Caused W Coin’s Price Drop, and Will It Bounce Back?

Understanding the factors behind WCO’s price drop is crucial for predicting its future. The decline from $0.001446 to $0.001465 was influenced by several market dynamics. The overall crypto market experienced a downturn, with Bitcoin and Ethereum also seeing declines. This broader market trend put pressure on WCO, as investors became more cautious.

However, there’s more to the story. WCO’s trading volume increased by 22.8% in the last 24 hours, signaling heightened interest and potential for recovery. The coin’s market cap remains at $4,366,031, showing that despite the drop, WCO still holds significant value.

Looking forward, several developments could catalyze a bounce back. WCO’s integration into more platforms and its focus on providing customized solutions for businesses could drive demand. Additionally, the coin’s active community and ongoing development efforts suggest a strong foundation for future growth.

Lessons From Ethereum: Could W Coin Follow a Similar Path?

Ethereum’s journey offers valuable lessons for WCO investors. Ethereum experienced a significant price drop in the past, particularly during the crypto winter of 2018. However, its commitment to development, particularly the transition to Ethereum 2.0, led to a remarkable recovery.

WCO, with its focus on being both a Layer 1 and Layer 2 blockchain, shares similarities with Ethereum’s ethos of innovation and adaptability. WCO’s ability to offer customized environments for specific clients and its advanced ledger functionalities could position it for a similar recovery path.

However, there are differences. Ethereum’s recovery was largely fueled by its dominance in the smart contract space, while WCO aims to carve out a niche in the payment infrastructure. If WCO can successfully market its unique features and attract a dedicated user base, it could follow a recovery trajectory akin to Ethereum’s.

Navigating the volatility of WCO requires a strategic approach. For beginners in the crypto investment world, understanding the key indicators is crucial. Tools like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands can help gauge the coin’s momentum and potential reversal points.

For instance, if WCO’s RSI indicates it’s in oversold territory, it might be a signal for a potential price increase. Similarly, if the MACD line crosses above the signal line, it could suggest a bullish trend. These indicators, combined with market sentiment and news, can provide valuable insights into WCO’s short-term movements.

Long-term, WCO’s focus on providing a flexible and secure payment infrastructure could drive sustained growth. Investors should keep an eye on developments within the WCO ecosystem, such as partnerships and platform integrations, which could boost the coin’s value.

Wrapping Up: The Road Ahead for W Coin

In conclusion, W Coin’s recent price drop from $0.001446 to $0.001465 has sparked both concern and intrigue among investors. While the immediate future may be uncertain, WCO’s unique features and strategic positioning in the market suggest a potential for recovery.

For those new to crypto investing, understanding the broader market trends and leveraging technical indicators can provide a clearer picture of WCO’s trajectory. Whether WCO follows a path similar to Dogecoin or Ethereum, its journey is one to watch closely.

As we navigate the volatility of the crypto market, WCO offers a compelling case study in resilience and innovation. With careful analysis and a long-term perspective, investors can position themselves to capitalize on WCO’s potential growth in the coming years.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.