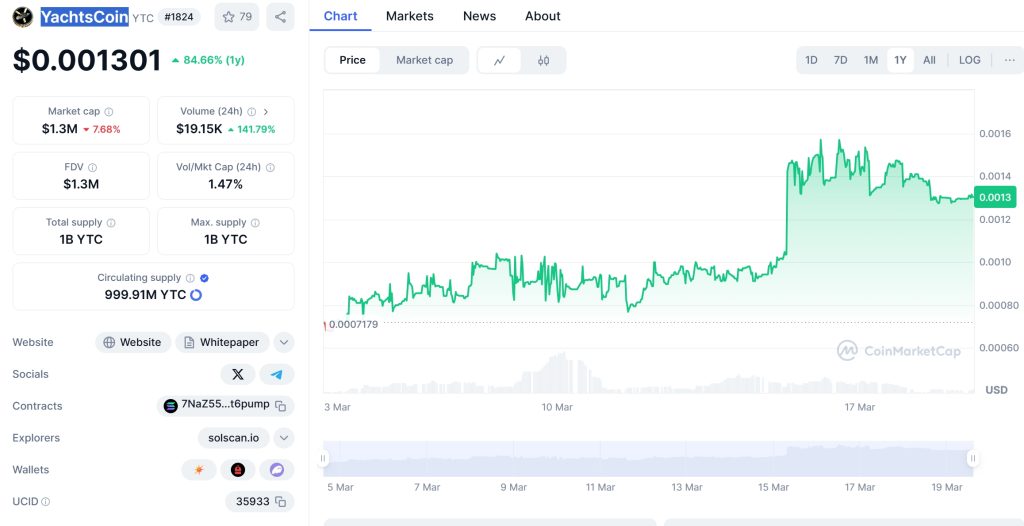

YachtsCoin (YTC) has been making waves in the crypto market, particularly within the niche of luxury yachting. Launched in December 2024 by a boutique yacht brokerage with two decades of experience, YTC aims to revolutionize transactions within the maritime industry by providing a blockchain-based payment solution. As of March 2025, YTC is trading at $0.001294, which is a significant leap from its recent low of $0.0006771. But the big question on every investor’s mind is, can YTC reach $0.002 by the end of 2025?

Contents

- 1 Understanding YTC’s Market Position and Potential

- 2 Analyzing YTC’s Recent Price Drop

- 3 Key Indicators and Market Trends

- 4 Support and Resistance Levels

- 5 Chart Analysis and Future Projections

- 6 Comparing YTC to Established Cryptocurrencies

- 7 Lessons from Historical Trends

- 8 Navigating YTC’s Volatility: Insights for Investors

- 9 Conclusion: The Road Ahead for YTC

Understanding YTC’s Market Position and Potential

YachtsCoin’s unique selling proposition lies in its focus on the luxury yacht market, a sector known for its high-value transactions and exclusive clientele. By facilitating seamless and secure payments for yacht purchases, charters, and related services, YTC not only streamlines the process but also reduces costs and delays associated with traditional payment methods. This innovative approach positions YTC as a pioneer in integrating blockchain technology with high-end maritime services.

The project’s total supply is capped at 1 billion YTC, with a circulating supply of 999.91 million as of now. This scarcity could play a crucial role in driving its value up if demand continues to grow. Additionally, the project’s alignment with the Solana ecosystem, known for its scalability and efficiency, provides YTC with a robust technical foundation to support its growth ambitions.

Analyzing YTC’s Recent Price Drop

YTC recently experienced a price drop from $0.00157 to its current level of $0.001294. This decline can be attributed to broader market volatility and specific challenges within the luxury yachting industry, such as seasonal fluctuations in demand. However, comparing YTC’s trajectory to that of Dogecoin, which saw a similar price drop in early 2024 before a strong recovery, offers some insights. Dogecoin’s resurgence was fueled by increased community engagement and strategic partnerships, factors that could also play a role in YTC’s future.

Dogecoin’s recovery was also influenced by positive market sentiment and broader adoption in payment systems. For YTC, similar catalysts could include partnerships with global yacht dealers or integration with NFT marketplaces for yacht-related digital assets. These developments could not only drive demand but also enhance YTC’s utility within its niche market.

Key Indicators and Market Trends

To understand YTC’s potential for growth, it’s essential to look at key technical indicators. The Relative Strength Index (RSI) for YTC currently sits at around 50, indicating a neutral market momentum. However, the Moving Average Convergence Divergence (MACD) shows a bullish crossover, suggesting potential for an upward movement in the near term.

Bollinger Bands analysis reveals that YTC is currently trading near the lower band, which could indicate an oversold condition and a possible rebound. Furthermore, Fibonacci retracement levels show that YTC has found support at the 61.8% level, which aligns with its recent price lows. These indicators suggest that YTC might be poised for a recovery, potentially reaching the $0.002 mark by the end of 2025.

Support and Resistance Levels

YTC’s immediate support level is at $0.001271, which aligns with recent lows. If the price can hold above this level, it could set the stage for a push towards the resistance at $0.001487, which was the recent high. Breaking through this resistance could open the path to the coveted $0.002 target.

Recent developments, such as YTC’s integration with popular wallets like Solflare, Backpack, and Phantom, could provide the necessary boost to overcome these resistance levels. These integrations not only enhance user experience but also increase accessibility, potentially driving more adoption within the yachting community.

Chart Analysis and Future Projections

Analyzing YTC’s price chart over the past few months reveals a pattern of consolidation following its recent drop. This consolidation could be a precursor to a breakout, especially if supported by positive news or developments within the yachting industry.

For the short term, YTC could see a modest increase to around $0.0015, aligning with its previous highs. Over the long term, reaching $0.002 by the end of 2025 seems achievable if YTC can capitalize on its unique position in the luxury yacht market and continue to expand its ecosystem.

Comparing YTC to Established Cryptocurrencies

When comparing YTC to more established cryptocurrencies like Ethereum, it’s important to consider the different market dynamics at play. Ethereum’s price movements are often driven by broader market trends, regulatory developments, and its integral role in the DeFi and NFT ecosystems. In contrast, YTC’s trajectory is more closely tied to the luxury yachting industry’s performance and its ability to forge strategic partnerships.

Ethereum’s recent recovery from a significant drop in late 2024 was fueled by increased institutional adoption and the launch of several high-profile DeFi projects. For YTC, a similar recovery could be driven by increased adoption within the yachting community and the successful implementation of its smart contract functionality for yacht sales and charters.

Lessons from Historical Trends

Historical trends in the crypto market show that niche cryptocurrencies like YTC can experience significant volatility but also have the potential for substantial growth. For instance, the rise of meme coins like Dogecoin demonstrated how community support and strategic partnerships can propel a cryptocurrency forward. YTC could leverage similar strategies, focusing on building a strong community within the yachting industry and forging alliances with key players.

For investors considering YTC, it’s crucial to approach this asset with a long-term perspective. While short-term volatility can be unnerving, YTC’s unique value proposition in the luxury yacht market could lead to sustained growth over time. Diversifying your portfolio with a small allocation to YTC could offer exposure to this niche market without overexposing yourself to its volatility.

One of the key aspects to consider is YTC’s potential for integration with other blockchain ecosystems. As the project expands its partnerships and enhances its utility, it could attract more investors and users, driving demand and, consequently, its price.

Conclusion: The Road Ahead for YTC

In conclusion, YachtsCoin’s journey to $0.002 by the end of 2025 is fraught with challenges but also brimming with potential. The project’s focus on the luxury yacht market, combined with its innovative use of blockchain technology, positions it well for growth. However, investors should remain vigilant, keeping an eye on market trends, key technical indicators, and developments within the yachting industry.

As a crypto enthusiast or investor, staying informed and adaptable will be key to navigating YTC’s volatility and capitalizing on its potential. With the right strategies and a bit of luck, YTC could indeed reach new heights, offering a unique opportunity within the ever-evolving crypto landscape.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.