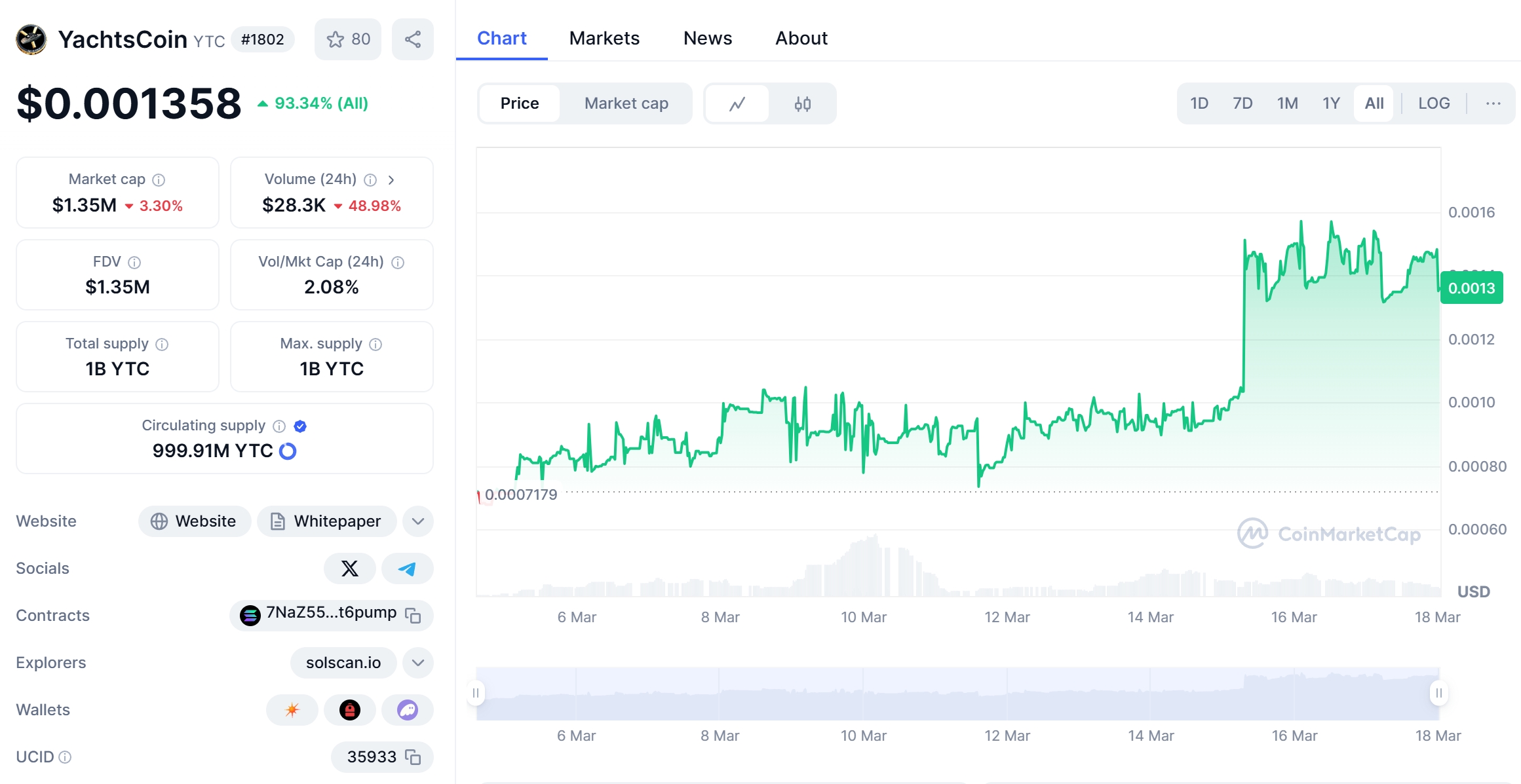

There’s arguably no hotter cryptocurrency on the planet right now than YachtsCoin (YTC). It’s now up more than 140% during the past three months, and shows no signs of stopping anytime soon. In 2025, it’s already up 14%, making it the top-performing major cryptocurrency within its niche. YTC’s recent surge has captured the attention of investors and enthusiasts alike, drawing them into the world of luxury and digital assets.

YachtsCoin, or YTC, has experienced a rollercoaster ride in recent months, capturing the market’s attention with large price swings and major developments. On March 16, 2025, the token surged to a multi-year high of $0.001546, fueled by strong market sentiment. However, the rally was short-lived, and YTC has since seen a decline to its current price of $0.001442. This fluctuation has left many investors wondering if YTC can maintain its momentum and what the future holds for this unique cryptocurrency.

YTC Price Prediction remains a hot topic as investors scrutinize every movement of YachtsCoin’s price, and today we dive deep into how these forecasts compare with the emerging promise of a new luxury-focused ecosystem. In a landscape filled with volatile digital assets, many wonder, “Would you buy YachtsCoin (YTC) at its current price?”

Contents

- 1 Can YachtsCoin Recover After Dropping to $0.001442?

- 2 What Caused YachtsCoin’s Price Drop, and Will It Bounce Back?

- 3 Lessons From Dogecoin: Could YachtsCoin Follow a Similar Path?

- 4 How to Navigate YachtsCoin’s Volatility: Expert Insights

- 5 Long and Short-Term Predictions for YachtsCoin

- 6 Navigating the Future with YachtsCoin

Can YachtsCoin Recover After Dropping to $0.001442?

The recent price drop of YTC from $0.001546 to $0.001442 has sparked concern among investors. To understand this better, let’s compare YTC’s trend to that of another popular cryptocurrency, Dogecoin (DOGE), which experienced a similar price movement in the past. In 2021, Dogecoin saw a significant drop after reaching an all-time high, influenced by market speculation and celebrity endorsements. However, DOGE managed to recover due to its strong community support and continued interest from retail investors.

YTC’s current situation shows some similarities, particularly in the influence of community sentiment and the potential for recovery. The luxury yachting industry, which YTC aims to revolutionize, is experiencing growth, driven by increasing demand for exclusive experiences and high-end services. This sector’s growth could provide a solid foundation for YTC’s recovery, much like the cultural phenomenon that supported DOGE’s rebound.

What Caused YachtsCoin’s Price Drop, and Will It Bounce Back?

The price drop of YTC can be attributed to several factors, including market volatility and the natural correction after a rapid surge. The luxury sector, while resilient, is not immune to broader economic conditions. However, YTC’s unique positioning as a memecoin with ambitious goals to surpass the value of the world’s most expensive yacht adds a layer of intrigue and potential for growth.

Recent news indicates that YTC’s team has secured significant investment, demonstrating credibility and potential for future development. Moreover, the project’s integration with high-end services and the launch of exclusive NFT collections have added to its appeal. These factors suggest that YTC could bounce back, especially as the luxury yachting industry continues to thrive.

Lessons From Dogecoin: Could YachtsCoin Follow a Similar Path?

Dogecoin’s journey offers valuable lessons for YTC. DOGE’s success was largely driven by community engagement and the power of social media. YTC can leverage its unique theme of luxury and exclusivity to build a similar community base. By fostering a strong community and continuing to develop its ecosystem, YTC could follow a path similar to DOGE’s recovery and growth.

The key difference lies in YTC’s focus on the luxury sector. While DOGE appealed to a broad audience, YTC targets a niche market with high potential for growth. This focus could lead to a different recovery path, one driven by the increasing demand for luxury experiences and the integration of blockchain technology in this sector.

Navigating the volatility of YTC requires a strategic approach. One of the key aspects to consider is the use of technical indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands. These tools can provide insights into market trends and potential reversal points.

For instance, the RSI can help identify if YTC is overbought or oversold, while the MACD can signal potential momentum shifts. Bollinger Bands can indicate volatility and potential price breakouts. By combining these indicators with an understanding of the luxury yachting industry’s trends, investors can make more informed decisions.

Recent news about YTC’s partnerships and developments in the luxury sector should also be closely monitored. These developments can impact support and resistance levels, which are critical price points that can influence YTC’s price movements. For example, a new partnership with a luxury yacht manufacturer could boost investor confidence and push YTC’s price above a key resistance level.

Long and Short-Term Predictions for YachtsCoin

In the short term, YTC’s price could see fluctuations as the market digests recent developments and adjusts to the luxury sector’s growth. However, the long-term outlook appears promising. The project’s ambitious goal to surpass the value of the world’s most expensive yacht, coupled with its focus on exclusive access and rewards, positions YTC for significant growth.

By 2026, YTC could reach $0.002, driven by increased adoption and the expansion of its ecosystem. By 2030, with continued development and market penetration, YTC could see a price of $0.005, reflecting its potential to become a leading player in the luxury crypto space. These forecasts are speculative but are grounded in the project’s current trajectory and the luxury sector’s growth trends.

As an investor in the crypto market, I’ve seen my fair share of volatility and potential. YTC’s recent price movements are part of the broader narrative of the crypto market, but its unique focus on the luxury yachting industry sets it apart. For those new to crypto investing, understanding the market conditions and external events that influence price movements is crucial.

The luxury sector’s resilience and growth provide a solid foundation for YTC’s future. By leveraging its community, continuing to innovate, and expanding its ecosystem, YTC could not only recover from its recent drop but also achieve significant growth in the coming years. As always, it’s essential to conduct thorough research and consider your risk tolerance before making any investment decisions.

In the world of crypto, where speculation and innovation intersect, YachtsCoin offers a unique opportunity to invest in luxury and digital assets. Whether it can navigate the waves of the market and reach new heights remains to be seen, but the journey promises to be an exciting one.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.