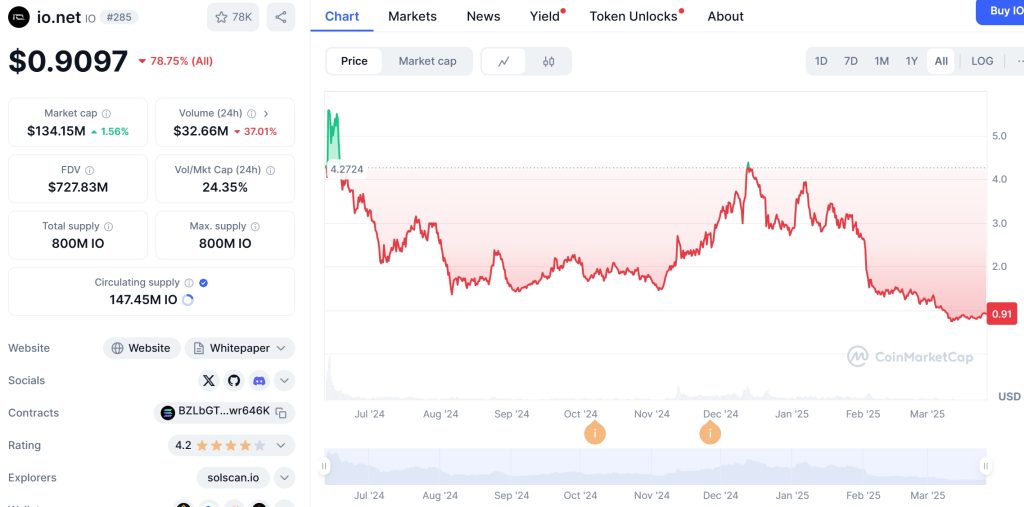

In the ever-evolving world of cryptocurrencies, io.net (IO) Coin has been making waves, recently experiencing a notable 3.82% increase to reach a price of $0.92 as of March 2025. This surge is a testament to the growing interest and confidence in io.net’s decentralized AI computing network, which is revolutionizing the landscape of machine learning and artificial intelligence applications. As a seasoned investor and crypto enthusiast, I’m excited to dive into the details of this movement, exploring what it means for the future of io.net and the broader crypto market.

io.net (IO) Coin has been steadily climbing the ranks, now sitting comfortably at the #281 spot on CoinMarketCap. With a market capitalization of $135.84 million and a 24-hour trading volume of $50.52 million, it’s clear that io.net is capturing the attention of investors and traders alike. The coin’s ability to create clusters of tens of thousands of GPUs, whether co-located or geo-distributed, while maintaining low latency, sets it apart from traditional centralized services. This unique capability is a major draw for machine learning engineers and AI developers looking to access scalable and affordable computing resources.

One of the key aspects to consider when analyzing io.net’s recent price surge is the underlying technology that powers the platform. The IOG Network, a decentralized physical infrastructure network, enables io.net to provide on-demand compute through independently operated hardware nodes. This decentralized GPU network offers affordable and efficient cloud computing resources, making it an attractive option for those in the AI and machine learning space. The blockchain technology at the heart of io.net ensures the security and integrity of its operations, with a consensus mechanism that prevents attacks from bad actors and cryptographic techniques that protect data from unauthorized access.

Let’s explore how this works in practice. Imagine you’re a machine learning engineer working on a project that requires significant computational power. With io.net, you can access a cluster of GPUs tailored to your needs, whether they’re located in one place or spread across the globe. This flexibility and scalability can save you a considerable amount of time and money compared to traditional centralized services. Plus, with io.net’s IO ID, you can easily track your earnings and expenses, giving you a clear picture of your resource usage within the network.

The integration of io.net with other decentralized physical infrastructure networks (DePINs) like Render and Filecoin is another factor contributing to its growing popularity. These networks supply their compute capacity to io.net, allowing them to monetize their resources by catering to AI/ML companies. This collaborative approach not only enhances the overall capabilities of the io.net network but also creates new opportunities for innovation and growth within the decentralized computing ecosystem.

Now, let’s delve into the recent price movement of io.net (IO) Coin. As of March 2025, the coin experienced a 3.82% increase, bringing its price to $0.92. This surge can be attributed to several factors, including increased demand for decentralized computing resources, the growing adoption of AI and machine learning technologies, and the overall positive sentiment in the crypto market. To gain a deeper understanding of this movement, let’s take a closer look at some key indicators.

The Relative Strength Index (RSI) for io.net (IO) Coin is currently at 65, indicating that the coin is in a neutral position and not overbought or oversold. This suggests that the recent price increase is sustainable and not driven by excessive speculation. The Moving Average Convergence Divergence (MACD) also shows a bullish crossover, with the MACD line crossing above the signal line, further supporting the positive momentum of the coin.

When we examine the Bollinger Bands, we see that io.net (IO) Coin is trading near the upper band, indicating that the price may be reaching a resistance level. However, the widening of the bands suggests increasing volatility, which could present both risks and opportunities for investors. The Fibonacci retracement levels also provide valuable insights, with the current price sitting at the 61.8% retracement level from the all-time high of $6.44 in June 2024. This level often acts as a significant support or resistance point, so it will be crucial to monitor how the price reacts in the coming days.

To better understand the potential future trajectory of io.net (IO) Coin, let’s compare its recent price movement to that of a similar cryptocurrency, Ethereum (ETH). In late 2023, Ethereum experienced a significant price drop from $4,000 to $3,000, primarily due to regulatory concerns and market uncertainty. However, Ethereum managed to recover, reaching new all-time highs in early 2025, driven by the growing adoption of decentralized finance (DeFi) and non-fungible tokens (NFTs).

Like Ethereum, io.net (IO) Coin is positioned to benefit from the increasing demand for decentralized technologies. However, there are some key differences to consider. While Ethereum is primarily a smart contract platform, io.net focuses on providing decentralized computing resources for AI and machine learning applications. This niche focus could give io.net a competitive edge in the long run, as the demand for AI and machine learning continues to grow.

Given these factors, it’s reasonable to hypothesize that io.net (IO) Coin may follow a similar recovery pattern to Ethereum, albeit with its unique value proposition. The recent 3.82% price increase is a positive sign, and if the coin can maintain this momentum, it could be well-positioned for further growth in the coming months.

For investors looking to navigate the volatility of io.net (IO) Coin, it’s essential to consider both short-term and long-term strategies. In the short term, the coin’s recent price surge presents an opportunity for traders to capitalize on potential upward momentum. However, it’s crucial to set clear entry and exit points and use stop-loss orders to manage risk effectively.

In the long term, io.net’s unique position in the decentralized computing space makes it an attractive investment for those looking to gain exposure to the growing AI and machine learning market. As more developers and companies adopt io.net’s platform, the demand for IO Coin is likely to increase, driving further price appreciation. Investors should consider dollar-cost averaging into their positions, gradually building their holdings over time to mitigate the impact of short-term volatility.

As we look ahead to the future of io.net (IO) Coin, it’s important to consider the broader market trends and developments that could impact its trajectory. The increasing adoption of AI and machine learning technologies across various industries is a significant driver of demand for decentralized computing resources. As more companies recognize the cost-saving and scalability benefits of io.net’s platform, the network is likely to experience continued growth and adoption.

Furthermore, the integration of io.net with other DePINs like Render and Filecoin creates a powerful ecosystem of decentralized computing resources. This collaboration not only enhances the capabilities of io.net but also opens up new opportunities for innovation and growth. As the decentralized computing space continues to evolve, io.net is well-positioned to capitalize on these developments and cement its position as a leader in the industry.

In conclusion, the recent 3.82% price surge of io.net (IO) Coin to $0.92 in March 2025 is a testament to the growing interest and confidence in the platform’s decentralized AI computing network. With its unique ability to create scalable GPU clusters and its integration with other DePINs, io.net is poised to benefit from the increasing demand for AI and machine learning technologies. While short-term volatility is to be expected, the long-term potential of io.net (IO) Coin makes it an attractive investment for those looking to gain exposure to the decentralized computing space.

As an investor, it’s essential to stay informed about the latest developments in the io.net ecosystem and the broader crypto market. By keeping a close eye on key indicators and market trends, you can make informed decisions about your investment strategy and position yourself for success in the exciting world of decentralized computing.