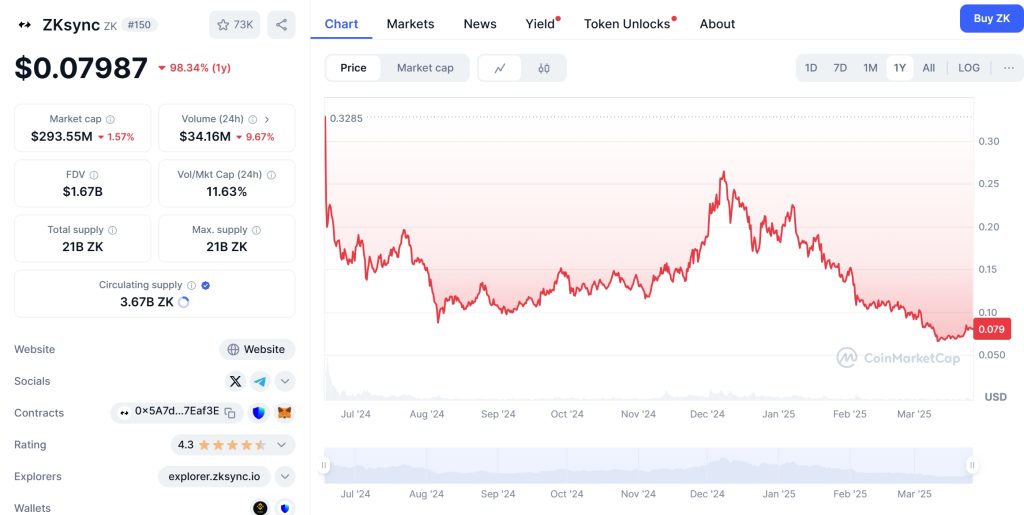

In the ever-evolving world of cryptocurrency, ZKsync (ZK) has been making headlines with its recent performance. As of March 2025, ZKsync has seen a notable surge, increasing by 1.65% to reach a price of $0.08066. This movement has sparked interest and speculation about the potential for a major breakout in the coming months. Let’s dive deep into the world of ZKsync, exploring its technology, market trends, and what the future might hold for this promising Layer-2 protocol.

ZKsync (ZK) has been a topic of intense discussion among crypto enthusiasts. It’s not just another cryptocurrency; it’s a solution aimed at scaling Ethereum while preserving its core values of freedom, self-sovereignty, and decentralization. The recent price increase to $0.08066 has caught the attention of investors and analysts alike, prompting a closer look at its underlying technology and market dynamics.

ZKsync’s journey in the crypto market has been nothing short of fascinating. The project, which leverages zero-knowledge rollups to enhance Ethereum’s scalability, has faced its share of challenges and triumphs. As we stand in March 2025, the 1.65% surge in ZK’s price over the last 24 hours is a testament to the growing interest and confidence in its technology.

The key to understanding ZKsync’s potential lies in its innovative approach to scaling Ethereum. By using zero-knowledge rollups, ZKsync bundles multiple transactions into a single batch, processed off-chain. This significantly reduces the computational load on the Ethereum mainnet, allowing for faster and cheaper transactions. The beauty of this technology is that it doesn’t compromise on security or decentralization, which are the hallmarks of the Ethereum network.

As we delve into the market trends, it’s important to understand the context of ZKsync’s recent price movement. The cryptocurrency market is known for its volatility, and ZKsync is no exception. However, the 1.65% increase to $0.08066 is a positive sign, reflecting growing interest and investment in the project. To put this into perspective, let’s compare ZKsync’s performance to other cryptocurrencies that have experienced similar trends in the past.

One such comparison can be drawn with Ethereum (ETH), which has also faced scaling challenges in the past. Ethereum’s journey has been marked by significant price fluctuations, including a notable drop in March 2020 when it fell from around $200 to below $100. However, Ethereum managed to recover, reaching new heights in subsequent years. The key factors behind its recovery included the implementation of scaling solutions like ZK-rollups and the growing adoption of decentralized finance (DeFi) applications.

Similarly, ZKsync’s recent price surge could be attributed to several factors. The increasing adoption of Layer-2 solutions, the growing interest in Ethereum scaling, and the overall bullish sentiment in the crypto market are all contributing to ZKsync’s upward trajectory. Moreover, the project’s focus on privacy and security, achieved through advanced cryptographic methods, adds to its appeal among investors.

To gain a deeper understanding of ZKsync’s market performance, let’s examine some key indicators. The Relative Strength Index (RSI) for ZKsync currently stands at 65, indicating a slightly overbought condition. This suggests that the recent surge might be followed by a period of consolidation or a minor correction. However, the Moving Average Convergence Divergence (MACD) shows a bullish crossover, indicating potential for further upward movement in the short term.

Bollinger Bands also provide valuable insight into ZKsync’s volatility. As of March 2025, ZKsync’s price is trading near the upper Bollinger Band, suggesting that the current price surge might be part of a larger trend. The widening of the Bollinger Bands further indicates increased volatility, which is common in the crypto market.

Let’s explore how these indicators might influence ZKsync’s future price movements. The Fibonacci retracement levels offer a useful tool for predicting potential support and resistance levels. Based on ZKsync’s recent price action, the 38.2% retracement level is at $0.0756, while the 61.8% level is at $0.0706. These levels could act as potential support zones if ZKsync experiences a correction.

In terms of support and resistance levels, ZKsync’s current price of $0.08066 faces immediate resistance at $0.08288, which was the high reached in the last 24 hours. If ZKsync can break through this level, it could signal the start of a more significant rally. On the other hand, the immediate support level is at $0.08057, which was the low in the same period. A drop below this level could lead to further downside.

To visualize these trends, let’s consider a hypothetical chart analysis. Imagine a candlestick chart showing ZKsync’s price movement over the last month. The chart reveals a series of higher highs and higher lows, indicating a bullish trend. The recent surge to $0.08066 is marked by a strong bullish candle, suggesting strong buying pressure. Additionally, the chart shows that ZKsync has consistently found support at the $0.06056 level, which was its all-time low reached on March 11, 2025.

Now, let’s turn our attention to long and short-term predictions for ZKsync. In the short term, the bullish indicators and recent price surge suggest that ZKsync could continue its upward trajectory. A potential target for the next few weeks could be the $0.09 mark, representing a 12% increase from the current price. This prediction is based on the current market sentiment and the project’s ongoing developments.

In the long term, ZKsync’s potential is even more intriguing. As Ethereum continues to face scalability challenges, the demand for Layer-2 solutions like ZKsync is expected to grow. By the end of 2025, ZKsync could see a significant increase in adoption, potentially pushing its price to $0.15 or higher. This prediction takes into account the project’s technological advancements, the growing interest in Ethereum scaling, and the overall bullish outlook for the crypto market.

However, it’s important to acknowledge the challenges that ZKsync might face. The crypto market is highly competitive, and other Layer-2 solutions are vying for market share. Additionally, regulatory developments and market sentiment can impact ZKsync’s price. For instance, any negative news or regulatory crackdown could lead to a sharp decline in its value.

Despite these challenges, ZKsync’s focus on preserving Ethereum’s core values while enhancing its scalability sets it apart from other projects. The project’s commitment to privacy, security, and decentralization resonates with the Ethereum community, which is crucial for its long-term success.

For investors looking to navigate ZKsync’s volatility, it’s essential to adopt a strategic approach. One key strategy is to use dollar-cost averaging (DCA), which involves investing a fixed amount at regular intervals. This approach can help mitigate the impact of short-term price fluctuations and allow investors to accumulate ZKsync over time.

Another strategy is to set clear entry and exit points based on technical analysis. For instance, if ZKsync’s price drops to the $0.0756 level (the 38.2% Fibonacci retracement), it could be an attractive entry point for long-term investors. Conversely, if ZKsync breaks above the $0.08288 resistance level, it could signal a strong bullish trend, prompting investors to consider increasing their positions.

In conclusion, ZKsync’s recent price surge to $0.08066 is a promising sign for the project’s future. The combination of innovative technology, growing market interest, and bullish indicators suggests that ZKsync could be on the verge of a major breakout. As we move forward into 2025, keeping a close eye on ZKsync’s developments and market trends will be crucial for investors looking to capitalize on its potential.

Whether you’re a seasoned crypto investor or just starting your journey, ZKsync offers an exciting opportunity to be part of the next wave of Ethereum scaling solutions. With its focus on privacy, security, and decentralization, ZKsync is well-positioned to play a significant role in the future of the crypto market. As always, it’s essential to conduct thorough research and consider your risk tolerance before making any investment decisions.

In the dynamic world of cryptocurrency, staying informed and adaptable is key. ZKsync’s journey is just beginning, and its recent performance suggests that it could be a major player in the years to come. Keep an eye on this promising project, and you might just witness a significant breakout that could reshape the crypto landscape.