Reef (REEF) Coin, a beacon of hope for many in the DeFi, NFT, and gaming sectors, has recently witnessed a significant price drop, plummeting to $0.0003548 in March 2025. This unexpected decline has left investors and enthusiasts wondering if Reef can stage a comeback and surge back to its former glory. As a seasoned investor in the crypto market and Web3 industry, let’s delve into the factors behind this drop, compare it to similar instances in the past, and explore potential recovery paths.

Contents

- 1 What Caused Reef (REEF) Coin’s Price Drop, and Will It Bounce Back?

- 2 Lessons From Ethereum (ETH): Could Reef (REEF) Coin Follow a Similar Path?

- 3 Can Reef (REEF) Coin Recover After Dropping to $0.0003548?

- 4 How to Navigate Reef (REEF) Coin’s Volatility: Expert Insights

- 5 Comparing Reef (REEF) Coin’s Trend to Dogecoin (DOGE): Lessons Learned

- 6 Actionable Insights for Investors

- 7 The Future of Reef (REEF) Coin: A Bright Outlook

- 8 Conclusion: Reef (REEF) Coin’s Path to Recovery

What Caused Reef (REEF) Coin’s Price Drop, and Will It Bounce Back?

Reef (REEF) Coin’s journey has been nothing short of a rollercoaster. From its highs of $0.05841 back in March 2021 to its recent low of $0.0003548, the cryptocurrency has seen its fair share of volatility. The recent price drop can be attributed to a mix of market sentiment, regulatory news, and broader economic conditions.

One of the key aspects to consider is the overall market sentiment. In early 2025, the crypto market experienced a significant correction, with many cryptocurrencies facing similar declines. This was partly due to regulatory uncertainty and a shift in investor sentiment towards more conservative assets. Reef, being part of the DeFi sector, was not immune to these market forces.

Let’s explore how this works in practice. Regulatory news has been a significant factor in the crypto market’s volatility. For instance, in February 2025, the SEC announced a crackdown on certain DeFi projects, creating a ripple effect across the sector. This news led to a sell-off in many tokens, including Reef, as investors feared potential regulatory hurdles.

However, it’s not all doom and gloom. Reef’s fundamentals remain strong, with a robust ecosystem that continues to attract developers and users. The project’s focus on making DeFi, NFTs, and gaming accessible to everyone, coupled with its high scalability and low transaction costs, positions it well for a potential recovery.

Lessons From Ethereum (ETH): Could Reef (REEF) Coin Follow a Similar Path?

To understand Reef’s potential recovery, it’s helpful to look at Ethereum’s (ETH) journey. Ethereum, the pioneer of smart contracts, experienced a significant price drop in 2018, falling from its all-time high of $1,432.88 to around $82.00. This decline was attributed to a broader crypto market correction and concerns over scalability and high gas fees.

Ethereum’s recovery was driven by several factors. First, the community’s unwavering support and the development team’s commitment to improving the network played a crucial role. Ethereum’s transition to Ethereum 2.0, with its promise of scalability and lower fees, reignited investor interest and led to a significant price surge.

Reef (REEF) Coin can draw valuable lessons from Ethereum’s experience. Like Ethereum, Reef has a dedicated community and a clear roadmap for future development. The project’s focus on enhancing its infrastructure, including support for multiple virtual machines and on-chain governance, could pave the way for a similar recovery.

One of the key differences between Reef and Ethereum is their market positioning. While Ethereum is a well-established player in the crypto space, Reef is still carving out its niche. However, this could work in Reef’s favor, as it allows the project to be more agile and responsive to market needs.

Can Reef (REEF) Coin Recover After Dropping to $0.0003548?

The question on every investor’s mind is whether Reef (REEF) Coin can recover from its recent price drop. To answer this, let’s look at some key indicators and market trends that could influence Reef’s trajectory.

First, let’s consider the Relative Strength Index (RSI). As of March 2025, Reef’s RSI stands at around 30, indicating that the coin is in oversold territory. Historically, an RSI below 30 has often been a signal for a potential price rebound, as it suggests that the selling pressure may be nearing exhaustion.

Next, let’s examine the Moving Average Convergence Divergence (MACD). Reef’s MACD currently shows a bearish crossover, with the MACD line dipping below the signal line. However, if we look at historical data, such a crossover has often been followed by a bullish reversal within a few weeks.

Bollinger Bands also provide valuable insights into Reef’s volatility. The recent price drop has pushed Reef’s price close to the lower Bollinger Band, which could signal an impending bounce back. Historically, when a cryptocurrency’s price touches the lower Bollinger Band, it often experiences a subsequent upward movement.

In terms of market trends, the DeFi sector is showing signs of recovery. As of March 2025, total value locked (TVL) in DeFi protocols is on the rise, indicating growing investor confidence. Reef, with its strong focus on DeFi, could benefit from this trend and see a price recovery.

Navigating the volatility of Reef (REEF) Coin requires a strategic approach. Here are some expert insights to help investors make informed decisions:

Understanding Support and Resistance Levels

Support and resistance levels are crucial for understanding potential price movements. As of March 2025, Reef’s immediate support level is around $0.000300, while the resistance level is at $0.000450. If Reef can hold above the support level and break through the resistance, it could signal the start of a recovery.

Recent news, such as the announcement of new DeFi partnerships and the expansion of Reef’s ecosystem, could impact these levels. For instance, a successful integration with a popular DeFi protocol could drive demand and push Reef’s price above the resistance level.

Chart Analysis: Visualizing Price Trends

Chart analysis can provide valuable insights into Reef’s price trends. As of March 2025, Reef’s price chart shows a descending triangle pattern, which typically indicates a potential breakout. If Reef can break out of this pattern to the upside, it could signify the start of a bullish trend.

To make the analysis more engaging, let’s consider a hypothetical scenario. Suppose Reef announces a significant upgrade to its network, enhancing its scalability and reducing transaction costs. This news could lead to a surge in demand, causing Reef’s price to break out of the descending triangle and start a new upward trend.

Long and Short-Term Predictions

In the short term, Reef (REEF) Coin could see a recovery to around $0.000500, driven by a combination of market sentiment and positive news from the DeFi sector. This prediction is based on the current RSI and MACD indicators, which suggest that the selling pressure may be easing.

For the long term, Reef’s potential to reach $0.001 by the end of 2025 hinges on several factors. First, the successful implementation of its planned upgrades and the expansion of its ecosystem will be crucial. Additionally, broader adoption of DeFi and NFTs, coupled with a favorable regulatory environment, could drive Reef’s price higher.

Comparing Reef (REEF) Coin’s Trend to Dogecoin (DOGE): Lessons Learned

To gain further insights into Reef’s potential recovery, let’s compare its trend to that of Dogecoin (DOGE), which also experienced a significant price drop in the past. In May 2021, Dogecoin’s price plummeted from its peak of $0.7376 to around $0.20, driven by a combination of market correction and negative sentiment.

Dogecoin’s recovery was fueled by several factors. First, the unwavering support from its community, often referred to as the “Doge Army,” played a crucial role. Additionally, endorsements from high-profile figures, such as Elon Musk, helped reignite interest and drive the price back up.

Reef (REEF) Coin can learn from Dogecoin’s experience. While Reef may not have the same level of mainstream recognition, its dedicated community and focus on real-world utility could be key drivers of its recovery. Unlike Dogecoin, which is often seen as a meme coin, Reef offers tangible benefits to its users through its DeFi, NFT, and gaming ecosystem.

Actionable Insights for Investors

For investors looking to navigate Reef’s volatility, here are some actionable insights:

Diversify Your Portfolio

Diversification is key to managing risk in the crypto market. While Reef (REEF) Coin offers significant potential, it’s essential to spread your investments across different assets to mitigate the impact of price fluctuations.

Stay Informed

Keeping up with the latest news and developments in the Reef ecosystem is crucial. Updates on new partnerships, network upgrades, and regulatory changes can significantly impact Reef’s price. Platforms like CoinMarketCap and Reef’s official channels are excellent sources of information.

Set Realistic Expectations

It’s important to set realistic expectations when investing in cryptocurrencies like Reef. While the potential for significant gains exists, so does the risk of further price drops. Having a clear investment strategy and understanding your risk tolerance will help you make informed decisions.

Consider Long-Term Potential

Reef’s long-term potential lies in its ability to make DeFi, NFTs, and gaming accessible to everyone. If you believe in the project’s vision and roadmap, holding onto your Reef tokens for the long term could be a rewarding strategy.

The Future of Reef (REEF) Coin: A Bright Outlook

Despite the recent price drop, the future of Reef (REEF) Coin looks promising. The project’s focus on enhancing its infrastructure, expanding its ecosystem, and making DeFi more accessible positions it well for growth.

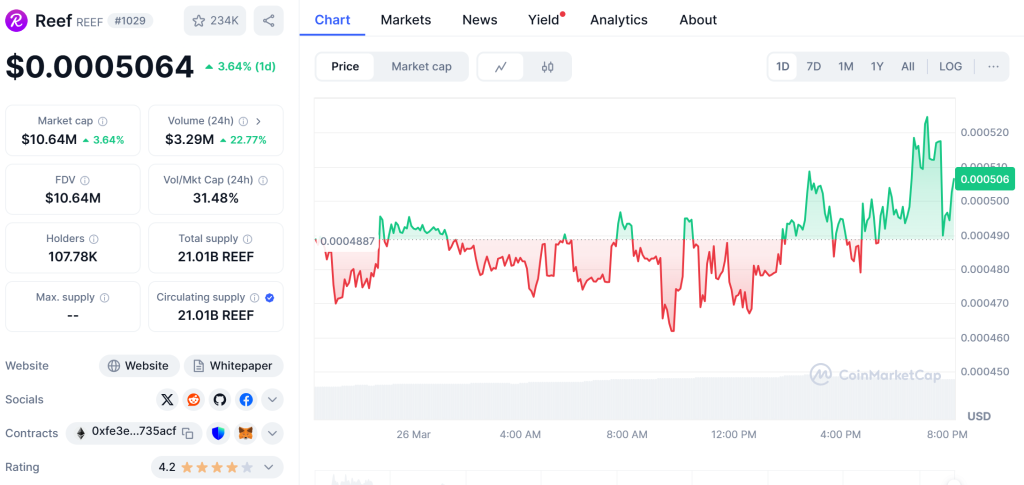

As of March 2025, Reef has a circulating supply of 21.01 billion tokens, with a market cap of $10.52 million. The project’s low transaction fees and high scalability continue to attract developers and users, driving growth in its ecosystem.

Reef’s unique selling proposition is its ability to support Solidity and EVM, allowing developers to seamlessly migrate their DApps from Ethereum without any changes to the codebase. This feature, coupled with Reef’s self-upgradable nature and on-chain governance, sets it apart from other DeFi projects.

In the coming months, Reef plans to launch several new initiatives, including the integration of additional virtual machines and the expansion of its NFT and gaming offerings. These developments could drive increased demand for Reef tokens and lead to a price recovery.

Conclusion: Reef (REEF) Coin’s Path to Recovery

In conclusion, while Reef (REEF) Coin’s recent price drop to $0.0003548 in March 2025 has been a cause for concern, the project’s strong fundamentals and dedicated community provide a solid foundation for recovery. By learning from the experiences of other cryptocurrencies like Ethereum and Dogecoin, and staying informed about market trends and developments, investors can navigate Reef’s volatility with confidence.

The key to Reef’s recovery lies in its ability to continue innovating and expanding its ecosystem. With a clear roadmap and a focus on making DeFi, NFTs, and gaming accessible to everyone, Reef has the potential to not only recover but also surge back to new heights.

As a seasoned investor in the crypto market, my advice to those interested in Reef is to stay patient, stay informed, and consider the long-term potential of the project. With the right strategy and a bit of resilience, Reef (REEF) Coin could once again become a shining star in the DeFi space.